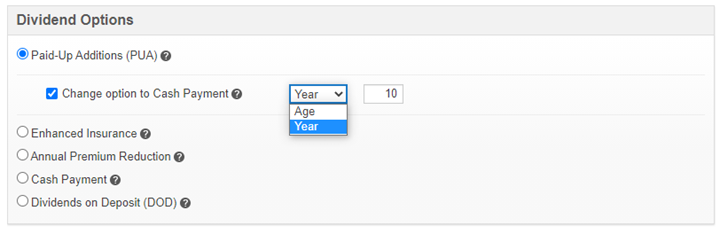

As of next week, when you offer participating whole life insurance coverage, you'll be able to illustrate a dividend option change. After 10 years, it will be possible to switch from paid-up additions to cash payment.

You'll be able to make the change based on the age of the person to be insured or after specific time period (minimum 10 years). For joint coverage, only the

Year option is available.

Note: If you choose this option, you won't be able to offer the premium offset.

Keep in mind that dividends aren't guaranteed. They vary, among other things, on investment return, mortality rates, taxes and fees. However, once paid out, dividends are vested to the policyowner and can't be clawed back by the insurer.

Important! Dividends paid in the form of paid-up additions aren't taxable, but could be taxable when paid by cheque to the policyowner if the amount of the dividend exceeds the adjusted cost base (ACB) of the policy.

Some situations where this change could be beneficial

- The person to be insured is a child and the policyowner wants to use future dividends to cover part of the cost of their education.

- The person to be insured has a medium- or long-term project that will require cash.

- The policyowner is a flourishing business that could reinvest the credited dividends to ensure its growth.

For more information on participating whole life insurance, refer to the

Advisor Guide or visit our

dedicated section.

To change the dividend option

If your client wants to change their dividend option,

when the time comes have them complete section B of the

Request for Change Without Evidence – 09219E form.

For an in-force policy

To illustrate a dividend option change on in-force policy, submit a request to

Expertise_Portefeuille_Backbook@dsf.ca.

Questions?

Contact your

regional sales director.

Business Development