Known for being simple and affordable, term products are very popular options. We are constantly adapting them to the market evolution to remain more competitive and attractive.

We are therefore pleased to announce that these term life insurance products’ rates will be lowered further. The average and maximum possible rate reductions are as follows:

| Products | Decrease average | Decrease maximum |

|---|

| Term 10 | -1.9% | -15.3% |

| Term 20 | -1.4% | -10.2% |

| Term 30 | -3.9% | -10.5% |

| Term 65 | -4.0% | -12.6% |

| Universal Life Term 10 | -1.8% | -15.1% |

| Universal Life Term 20 | -1.4% | -9.9% |

This product line is perfect for meeting predetermined financial needs to cover a person's financial obligations following their death.

Depending on certain factors, such as the person's age, the capital to be insured and the product selected,

this rate decrease may be lower or higher.

Market position

Dated October 4, 2022

| Female NS, age 40 | $250,000 | $500,000 | $1,000,000 | # of companies |

|---|

| Term 10 | 4 | 3 | 1 | 18 |

| Term 20 | 1 | 2 | 1 | 17 |

| Term 30 | 4 | 7 | 5 | 18 |

| Term 65 | 1 | 1 | 1 | 3 |

| Male NS, age 40 | $250,000 | $500,000 | $1,000,000 | # of companies |

|---|

| Term 10 | 4 | 3 | 3 | 18 |

| Term 20 | 1 | 2 | 1 | 17 |

| Term 30 | 2 | 6 | 5 | 18 |

| Term 65 | 1 | 1 | 1 | 3 |

We can be proud to be the ranked

1st on the market in several categories!

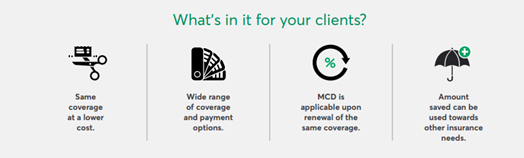

Multi-Coverage Discount

Would you like to offer a low rate to your clients for our term life insurance products*? You can thanks to the Multi-Coverage Discount, an excellent option for covering all their needs and staying on budget!

By purchasing at least 2 eligible insurance coverage products on the same policy and at the same time, they will get the following benefits:

* Term universal life insurance isn't eligible for the Multi-Coverage Discount.

Refer to the quick

reference document for more information.

Transition rules

Applications still under review at the time of the change will automatically benefit from a better rate.

Important note:

Illustrations saved before October 22

If you saved some illustrations before October 22 and wish to use them after that date, you must update the initial illustrations before importing them into the electronic application.

Applications started before October 22 and not submitted

You will not be able to submit them after this date. To do so, you must contact Merchandising Technology or your technical support.

Important note:

Illustrations saved before October 22

If you saved some illustrations before October 22 and wish to use them after that date, you must update the initial illustrations before importing them into the electronic application.

Applications started before October 22 and not submitted

You will not be able to submit them after this date. To do so, you must contact Merchandising Technology: 1-800-461-3914 or

mtsupport@dfs.ca.

Important note:

Illustrations saved before October 22

If you saved some illustrations before October 22 and wish to use them after that date, you must update the initial illustrations before importing them into the electronic application.

Applications started before October 22 and not submitted

You will not be able to submit them after this date. To do so, you must contact

Merchandising Technology: 1-866-668-SPOC (7762) - option 1-2

Other advantages of our term products

-

Conversion privilege: Term products can be converted into permanent products until the age of 70, without providing proof of insurability

-

Exchange option: certain temporary products may be replaced by longer-term temporary coverage.

-

Association option: individual coverage can be exchanged for joint coverage, which means adding other insurers, until the age of 70.

Questions?