What to do if a person is declined

You can offer your clients 2 coverage options if one of the proposed insureds is declined:

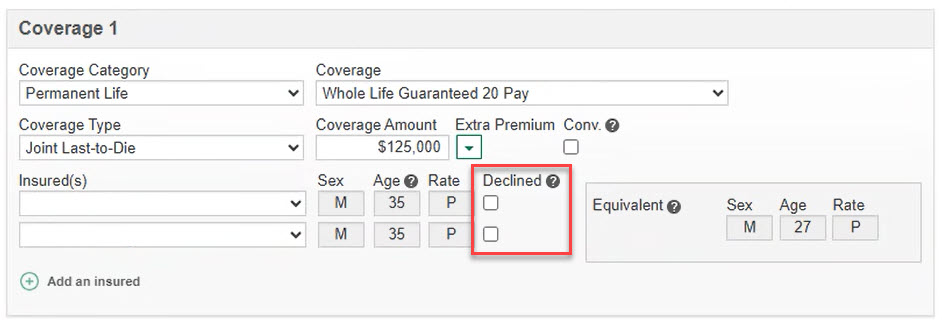

Option 1: Joint last-to-die coverage

A. Premium calculated based on the age of the approved person minus 1 year

Examples

| Scenario | Sex | Age | Rate | Decision | Premium calculation info |

|---|

| 2 people approved | Male | 64 | Non-smoker | Approved | Male NS, 56 |

| Female | 62 | Smoker |

| 1 person approved and 1 declined | Male | 64 | Non-smoker | Approved | Male NS, 63 |

| Female | 62 | Smoker | Declined |

| 1 person approved and 1 declined | Male | 64 | Non-smoker | Declined | Female S, 61 |

| Female | 62 | Smoker | Approved |

B. Premium calculated based on the age of the approved person minus 1%

If we can't offer option A, it’s still possible to choose joint last-to-die coverage.

The premium is then calculated based on the age of the approved person and is the

same as the premium for individual coverage minus 1%.

How to get option A or option B

You need to create a new illustration and send it to us in the Pending Business tool (PB tool). The policy will be produced with a notice of modification to be signed by the policyowner.

Option 2: Individual coverage

- The policy will insure only the approved person

- The premium is calculated based on the approved person

How to obtain this coverage

You need to create a new illustration and send it to us in the PB tool. The policy will be produced with a notice of modification to be signed by the policyowner.

Change in insurability of the person declined

If the person's health conditions improve, they can request a review of their insurability.

Policies in force for less than 1 year

The change can be made retroactively to the issue date to maintain the insured person's age. In this case, complete an insurance application, including evidence of insurability, and enter a note to that effect in the Special instructions section.

Policies in force for 1 year or more

Proceed by replacement.