Tax Treatment

In a non-registered Contract, the tax treatment of Guarantee Advantage lets your clients defer the taxation of the income on their Contract for a few years, even beyond the Deposit Maturity Date1. Plus, the accrued income on the product is eligible for pension income tax credits!2.

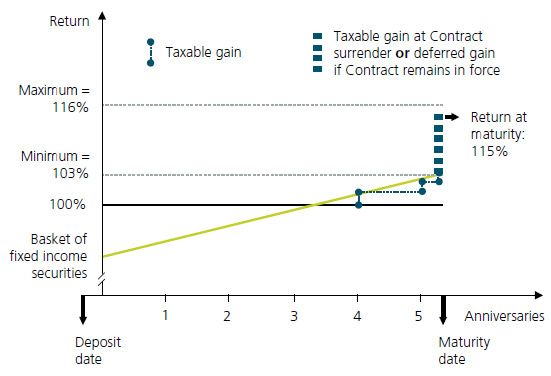

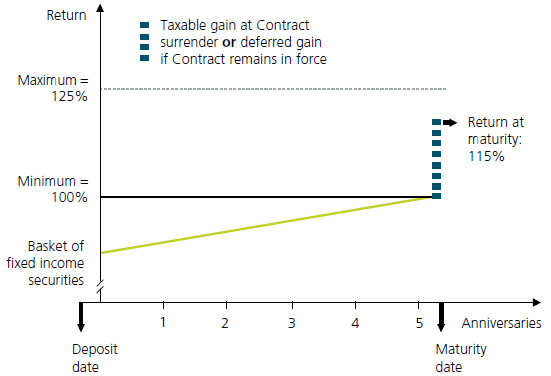

Tax treatment of Guarantee Advantage – 5-year term

Tax treatment when minimum return is greater than 0%

Tax treatment when minimum return is 0%

Before the deposit matures

Guarantee Advantage is taxed annually on the Contract's anniversary date. On all Contract anniversary dates, the taxable income is calculated based on the “accumulation fund”. This fund is equal to either the Surrender Value3 or the Current Value of the minimum guarantee as determined by Desjardins Insurance (value of the basket of fixed income securities), whichever is greater. The tax is generally nil in the first few years of the term, when Guarantee Advantage’s minimum return is greater than 0%. The tax is nil before maturity, when Guarantee Advantage’s minimum return is equal to 0%.

At the deposit maturity date, your clients have two options:

- Redeem their Contract: They will be taxed on the gains that exceed the value already taxed during the term.

- Reinvest: Taxation in the year including the next anniversary date of the Contract .

Example

- Deposit of $1,000 in GA Financials - 5 years, March 1, 2015

- Maturity date: April 10, 2020

- Value at maturity: $1,150

The tax treatment at maturity will be different depending on whether the client surrenders the Contract or decides to reinvest.

- Contract surrender

- The client has chosen option 3-16 (minimum return greater than 0%)

The client will be taxed each year from the time the value of the basket of fixed income securities is greater than the value of the Initial Deposit.

| Year | Taxable gain |

|---|

| 2016 | 0 |

| 2017 | 0 |

| 2018 | 0 |

| 2019 | 8 |

| 2020 | 20 |

|

Total |

28 |

Total taxable gain4: $150 ($1,150 – $1,000)

As the client has already been taxed on $28, he or she will be taxed only on the remaining $122 at maturity, in April 2020. As the client will be surrendering the Contract at that time, the $142 ($122 + $20) will be taxable in 2020.

- The client has chosen option 0-25 (minimum return of 0%)

The client will not be taxed during the term because the value of the basket of fixed income securities will never exceed the value of the Initial Deposit.

There will be a taxable gain of $150 at maturity, in April 2020, because the client will be surrendering the Contract at that time.

- Reinvestment in the Contract

The annual taxation will remain the same throughout the term.

- The client has chosen option 3-16 (minimum return greater than 0%)

The client will be taxed each year from the time the value of the accumulated fund is greater than the value of the Initial Deposit.

| Year | Taxable gain |

|---|

| 2016 | 0 |

| 2017 | 0 |

| 2018 | 0 |

| 2019 | 8 |

| 2020 | 20 |

|

Total |

28 |

Total taxable gain: $150 ($1,150 – $1,000)

As the client has already been taxed on $28, he or she will be taxed only on the remaining $122. The gain will be taxed the year in which the next anniversary date of the Contract occurs5, that is, in 2021.

- The client has chosen option 0-25 (minimum return of 0%)

The client won’t be taxed during the term because the value of the basket of fixed income securities will never exceed the value of the Initial Deposit.

There will be a taxable gain of $150 at maturity in April 2020. This policy gain will be taxed the year in which the next anniversary date of the Contract occurs5, that is, in 2021.

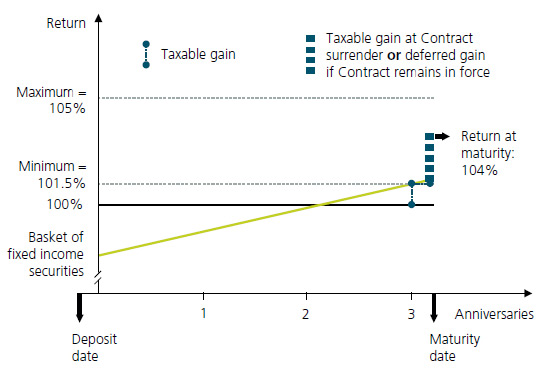

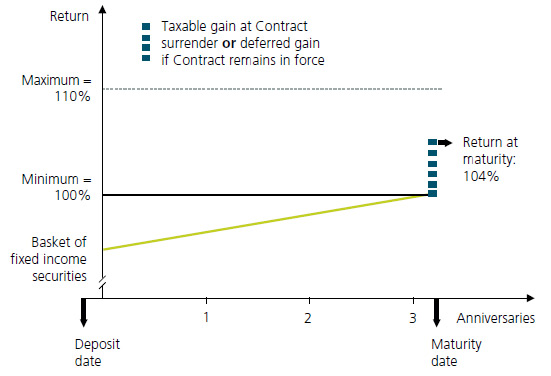

Tax treatment of Guarantee Advantage – 3-year term

Tax treatment when minimum return is greater than 0%

Tax treatment when minimum return is 0%

Before the deposit matures

Guarantee Advantage is taxed annually on the Contract's anniversary date. On all Contract anniversary dates, the taxable income is calculated based on the “accumulation fund”. This fund is equal to either the Surrender Value6 or the Current Value of the minimum guarantee as determined by Desjardins Insurance (value of the basket of fixed income securities), whichever is greater. The tax is generally nil in the first few years of the term, when Guarantee Advantage’s minimum return is greater than 0%. The tax is nil before maturity, when Guarantee Advantage’s minimum return is equal to 0%.

At the deposit maturity date, your clients have two options:

- Redeem their Contract: They will be taxed on the gains that exceed the value already taxed during the term.

- Reinvest: Taxation in the year including the next anniversary date of the Contract.

Example

- Deposit of $1,000 in GA Financials - 3 years, March 12, 2015

- Maturity date: April 10, 2018

- Value at maturity: $1,040

The tax treatment at maturity will be different depending on whether the client surrenders the Contract or decides to reinvest.

- Contract surrender

- The client has chosen option 1.5-5.5 (minimum return greater than 0%)

The client will be taxed each year from the time the value of the basket of fixed income securities is greater than the value of the Initial Deposit.

Total taxable gain7: $40 ($1,040 – $1,000)

As the client has already been taxed on $14, he or she will be taxed only on the remaining $26 at maturity, in April 2018. Since the client will be surrendering the Contract at that time, the taxable amount in 2018 will be $40 ($26 + $14).

- The client has chosen option 0-10 (minimum return of 0%)

The client won’t be taxed during the term because the value of the basket of fixed income securities will never exceed the value of the Initial Deposit.

There will be a taxable gain of $40 at maturity, in April 2018, because the client will be surrendering the Contract at that time.

- Reinvestment in the Contract

The annual taxation remains the same throughout the term.

- The client has chosen option 1.5-5.5 (minimum return greater than 0%)

The client will be taxed each year from the time the value of the basket of fixed income securities is greater than the value of the Initial Deposit.

| Year | Taxable gain |

|---|

| 2016 | 0 |

| 2017 | 0 |

| 2018 | 14 |

|

Total |

14 |

Total taxable gain: $40 ($1,040 – $1,000)

As the client has already been taxed on $14, he or she will be taxed only on the remaining $26. This policy gain will be taxed the year in which the next anniversary date of the Contract occurs8, that is, in 2019.

- The client has chosen option 0-10 (minimum return of 0%)

The client won’t be taxed during the term because the value of the basket of fixed income securities will never exceed the value of the Initial Deposit.

There will be a taxable gain of $40 at maturity, in April 2018. This policy gain will be taxed the year in which the next anniversary date of the Contract occurs8, that is, in 2019.

1 Clients should always keep an Investment Option in force in the Contract. That way, they’ll maximize the benefits of Guarantee Advantage’s tax treatment. Term investments (including the Daily Interest Fund) and market-linked term investments are offered through the Desjardins Financial Security Life Assurance Company Term Investments Contract.

2 Conditions apply. At the federal level, the person must be over 65 before the end of the taxation year to be allowed to include Guarantee Advantage's income in the credit calculation. The gain generated at the Contract's surrender (partial or total) is not eligible for pension income tax credits.

3, 6 The Surrender Value of Guarantee Advantage before maturity cannot be greater than the value of the Initial Deposit.

4, 7 To make things simpler, we are using the expression “taxable gain” to describe the income earned over the term of the Contract, which is taxable under subsection 12.2(1) of the Income Tax Act, and the gain on the Contract’s surrender, which is taxable under subsection148(1) of this Act. The difference between these two types of income can be important for the purpose of certain deductions or certain tax credits. However, they are both fully taxable because they are not considered to be capital gains.

5, 8 Please note that if the client deposited in an existing Contract, the anniversary date of the Contract will not be the anniversary date of the Deposit in Guarantee Advantage but the anniversary date of the first Deposit in the Contract.