Your business owner client obtains a permanent insurance contract on the life of a shareholder. Premium payments are made using surplus revenue or a reallocation of passive investments.

Since the corporation is the beneficiary of the policy, the death benefit is received tax-free upon the passing of the insured shareholder. A significant portion of this benefit creates a credit to the Capital Dividend Account (CDA), which can then be used to pay a non-taxable dividend to the deceased shareholder’s estate.

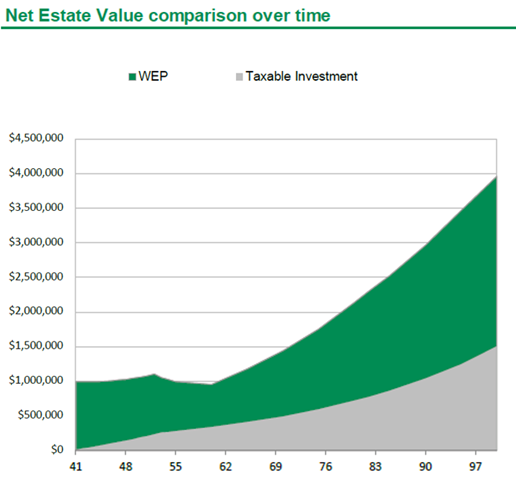

The corporate wealth escalator plan compares the allocation of surplus cash flow into an exempt life insurance policy rather than a traditional investment, thereby reducing the corporate income from passive investments each year. It provides a greater after-tax settlement to the shareholder’s estate in comparison to a taxable corporate investment. This concept is designed to illustrate this strategic advantage.

Advantages

Protection

From the time of purchase, the life insurance contract addresses the risk management need of the corporation. Furthermore, the death benefit can grow over time to provide for future corporate growth and increased coverage needs.

Tax preferred growth

The qualified life insurance policy allows the accumulation of cash values that grow tax-deferred, contrary to a typical corporate investment whose income and capital growth is subject to tax. Furthermore, the coverage provides a tax-free death benefit to the corporation, a significant amount of which can be transferred to the shareholder’s estate through a non-taxable dividend.

The example below compares the net estate value of the corporate wealth escalator and the taxable corporate investment. This example uses Participating Whole Life insurance policy with Paid-Up Additions (PUA) dividend options and premium offset after 14 years.

Reduce the tax burden of corporate investments

The tax-deferred growth of the cash value within a qualified life insurance policy does not increase the adjusted aggregate investment income (AAII) of the corporation. This is contrary to traditional corporate investments whose income is taxed annually. Furthermore, the adjusted cost base (ACB) of the life insurance policy is the only portion of the death benefit that can not flow through the CDA as a non-taxable dividend. This can greatly increase the values of the shareholder’s estate.

Portfolio diversification

Permanent life insurance provides an effective means of diversifying the investment portfolio of the corporation. Especially when Participating Whole Life insurance is utilized, asset growth is significant with smoothed returns that can bolster the efficacy of portfolio diversification.

Accessing cash values

The cash surrender value of the life insurance contract is accessible to the corporation while the insured shareholder is living. The corporation can also assign these values as collateral in order to negotiate preferred lending rates.

Applicable products

- Guaranteed whole life insurance

- Participating whole life insurance

- With Paid-Up Additions (PUA) or Enhanced Insurance as the dividend options