Annual statement | Participating whole life insurance

In order to better support clients with a participating life insurance product, a statement is sent to them each year on the policy anniversary date.

Written in clear language, our new statement is detailed and easy to understand, allowing your clients to see their policy's financial values and variations since the last policy anniversary.

Your clients’ product statements are available in the

Client Documents tool.

Learn about each section

|

| Product name and policy anniversary date

|

|

Name and address of the policyowner (individual or business) receiving the statement.

If there's more than one policyowner, we'll send the annual statement to the policyowner whose name appears first on the insurance application.

|

|

Contact person and their details to get information.

This is the advisor. If no advisor is assigned to the policy, the contact information of the Client Relations Centre will appear.

|

| Policy number and the names of all the policyowners and insured persons, excluding the insured persons under additional coverage.

|

|

Summary of policy values

Overview of the different values accumulated since the policy was purchased.

|

|

|

|

|

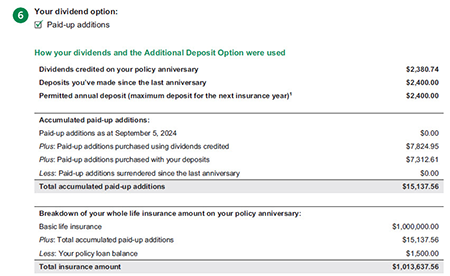

Dividend option in the policy, use of dividends, use of the Additional Deposit Option

Details about the value of dividends and composition of the insurance amount payable upon death.

If the policy includes the Additional Deposit Option, the

permitted annual deposit for the next year is indicated, among other things.

|

|

|

|

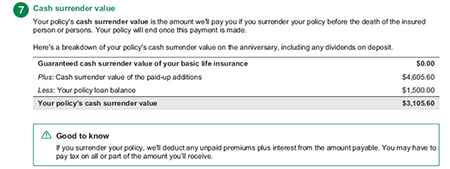

| Details on the variations in the cash surrender value, including important information to keep in mind when terminating the policy.

|

|

|

|

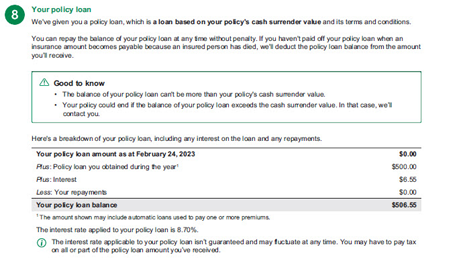

| If applicable, details on variations in the policy loan, including important information.

|

|

|

|

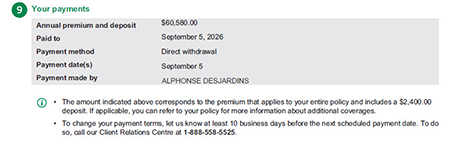

| Information about the payment, including deposits for the Additional Deposit Option, if applicable.

|

|

|

|

| Important information about the dividend scale.

|

|